-

What is a Green Freeport?

Green Freeports are places where business can be carried out inside a country’s land border, but where the normal tax and customs rules don’t apply in full. They have boundaries agreed with both the UK government and Scottish government.

They contain two types of sites where special rules apply, which can overlap. These are called ‘tax sites’ and ‘customs sites’. Companies can choose to locate themselves so that they profit from the benefits offered by one of these site types, or a combination of both.

Check out our “What is a Green Freeport” video.

-

What do Green Freeports do?

Green Freeports are intended to stimulate economic activity in their designated areas. The main intention is to attract inward investment to build new facilities such as manufacturers or research and development facilities which bring jobs to an area, taking advantage of the incentives available inside the Green Freeport area.

-

How will the Green Freeport be managed?

The Inverness & Cromarty Firth Green Freeport will be overseen by an independent company limited by guarantee (CLG). Its Board comprises a mix of public, private, and academic representatives, providing balanced leading oversight.

While its day-to-day operations will ultimately be governed by this Green Freeport company, Highland Council acts as the Accountable Body, responsible for receiving and safeguarding public funding and ensuring compliance with procurement rules. Once the governance structure is fully in place, the Freeport governing body will assume full strategic direction for using those funds.

This framework ensures that the Green Freeport blends public accountability with agile governance to attract investment, support innovation, and deliver economic and environmental benefits.

Check out our "How will the Green Freeport be managed" video.

-

What kind of jobs are coming and where can we find out more about them?

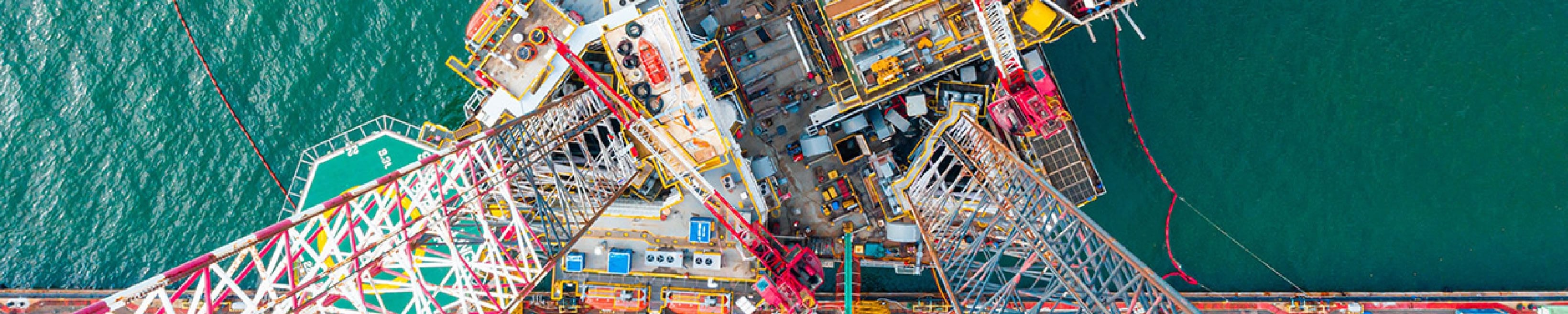

The Inverness and Cromarty Firth (ICF) Green Freeport will create a wide variety of jobs across key growth sectors such as green energy, offshore wind, and life sciences. As the Freeport develops, new employment opportunities will become available through both our own initiatives and those of our project partners.

For up-to-date information on available roles, please visit Job Opportunities page.

Find more information in our "What kind of jobs are coming" video

-

How will the area cope with the new activity?

The increased activity from the Inverness and Cromarty Firth Green Freeport will bring growth, but it also presents challenges—particularly in areas like housing and local infrastructure. Steps are already being taken to prepare for this, with a strong focus on planning and collaboration.

Funds raised through non-domestic rates will be reinvested locally to help increase capacity and improve essential services. The Green Freeport team is working closely with partners such as the Highland Council, housing associations, and house builders to plan for the future and ensure that the region can support this growth sustainably.

Check out our video "How will the area cope"

-

How will Inverness and Cromarty Firth Green Freeport be run?

Inverness & Cromarty Firth Green Freeport is an independent company limited by guarantee (CLG) which has a Board made up of a mixture of public, private and academic partners.

Find out more about our Board of Directors here.

-

Where can I find the Articles of Association?

The Inverness & Cromarty Firth Green Freeport Articles of Association can be found here.

-

How will existing businesses benefit?

The Green Freeport and the tax and customs incentives attached to it will attract new investors into the area; many of whom will need services, expertise and/or technologies from the local supply chain. This is already starting and the main sectors surrounding these investments are offshore wind and green hydrogen. Following the announcement, some other connected sectors are now starting to enquire about setting up in the Highlands.

We will be able to share more about this as details emerge and become public – many of these discussions are kept commercially confidential in their early stages.

Businesses will also benefit from the general uplift in economic activity in the area catalysed by the Green Freeport. They will also benefit from the expected increase in the labour force and from the training that will be delivered in the area to help people ensure they are ready for these new jobs.

In our Green Freeport, the National Insurance tax reliefs offered by the Governments will be reinvested into a training fund to provide skills and training for local people. This will be delivered via The PowerHouse project.

Check out our video “Can businesses benefit from the tax incentives or customs sites?”

-

What incentives are available to businesses?

Green Freeport status unlocks various tax incentives for businesses, encouraging them to set up facilities in the Highlands. For example:

- Land & Building Transaction Tax (LBTT) Relief.

- Enhanced Structures & Buildings Allowance (SBA): accelerated relief to reduce taxable profits by 10% of cost of investment every year for 10 yrs (compared to standard 3%p.a. over 33 1/3 yrs).

- Enhanced Capital Allowances (ECA): reduce taxable profits by full cost of qualifying investment in new plant/machinery in same tax period as cost was incurred.

- Employer NICS: 0% employer NICs on salaries of any new employee working in Green Freeport tax site. Applicable for <3 yrs per employee on earnings <£25,000p.a. threshold. NICs to be reinvested in training fund for our Green Freeport to prevent local displacement and incentivise training

- Non Domestic Rates Relief (NDRR): Businesses may be eligible for <100% relief from NDR on certain properties and property improvements within tax sites for <5 yrs from point of first relief.

Any growth in non-domestic rates over an agreed baseline will be retained by the Highland Council for the next 25 years and available for reinvestment within the Freeport boundary. It is hoped this will create a positive cycle of sustainable reinvestment; creating jobs and economic growth for decades and building on the initial few years of the Freeport status.

There are also customs benefits for companies importing / exporting materials or components via the customs sites that will be established within the Freeport. These include simplified customs procedures and cashflow benefits surrounding the payment of duty and/or VAT on components which are imported and re-exported. We are working hard with HMRC and the UK’s customs departments to better understand how these will operate in reality and will share more details in due course.

-

What does Green Freeport Employee mean?

Employees are classed as working within a Freeport tax site if they spend at least 60% of their working hours within that tax site.

-

What do Customs sites mean?

Inside a customs site, port operators and other companies are able to defer tax duty and import VAT on goods. If a product comes from outside of the UK into the customs site, such as a raw material or a component part, no tax is paid on that coming into the port unless it then leaves the port area and enters the UK.

-

What does this mean for manufacturers or producers?

If a manufacturer or a producer is located inside a customs site, it can handle those goods and use them to create their finished product.

They would only pay tax on their product if it then enters the UK. They can export to an international market without paying tax.

This could create a competitive advantage for Scotland versus producing goods abroad.

-

Will the Green Freeport provide training for new skills?

The National Insurance Contribution reliefs will be reinvested in the Inverness and Cromarty Firth Green Freeport into a training and skills development fund through The Powerhouse. This was important to the regional consortium who delivered the bid, as we didn’t want local businesses outside the Freeport fence to be at a disadvantage to those within in terms of wages paid. It is also part of the Fair Work pledge the Scottish Government pressed for in Green Freeports.

The idea is to give the local people the skills they need to find a job in the region’s renewables industry, delivering benefits to the local economy and strengthening local communities with green secure jobs.

-

Will there be sufficient housing to accommodate the forecasted workforce?

The Highland business community is united in its vision to drive the region’s local economy, creating jobs, wealth and a bright future for people. The Green Freeport is at the heart of this, but its success will require collaboration and this includes ensuring we have supporting infrastructure in place, with housing being a significant part of that. A very important factor is ensuring the right mix of housing is available in the area, including affordable entry-level homes and accommodation for letting. We encourage the public and private sectors to work together to accelerate their vision for housing in the area to meet the growing need.”

-

What safeguards are in place to prevent any illicit activity within the Freeport?

ICFGF operates within UK and Scottish regulatory frameworks, including HMRC controls for customs sites, standard compliance requirements, and governance oversight via the accountable body (Highland Council) and the Freeport company. Indeed, freeports come under some of the most robust legislation and scrutiny in the UK. Customs site rules are designed to simplify processes without removing legal obligations, and operators must comply with security and reporting requirements. We will publish key governance documents and provide transparency on how public funds and retained revenues are used.

-

Will the Green Freeport create new economic activity, or just move jobs and investment from other parts of Scotland / UK?

ICFGF’s goal is to attract investment that is tied to place-specific strengths—ports, proximity to offshore wind, available sites, and regional capabilities—so that activity is additive rather than relocated. We will track and report on outcomes like job creation, supply-chain contracts, skills investment, and inward investment, and we’ll work with partners to minimise displacement risks by focusing incentives and training on net-new activity and workforce growth.

-

How will you ensure jobs are fair, local people benefit, and working standards are protected?

As a Green Freeport, ICFGF is expected to align with fair work and deliver inclusive growth. A key mechanism is that elements of relief (e.g., NICs relief) are intended to be reinvested into skills and training so local people can access new opportunities, alongside partnerships that build clear pathways into jobs. We’ll prioritise quality employment, training progression, and transparent reporting on workforce outcomes—so communities can see tangible benefits, not just headlines.

FAQs

A range of questions and answers covering various topics